- Flexible OLED enters mass production period

Recently, some research reports believe that from the perspective of smartphone manufacturers in 2018, the flagship models represented by Samsung Galaxy Note9 and Apple iPhoneXS all use AMOLED screens. AMOLED is also widely used in various flagship and high-end models. The effect of smartphone AMOLED instead of a-SiTFT and LTPS/OxideTFTLCD is emerging. It is expected that OLED screens will continue to penetrate from the flagship model to the mid-range model in the future.

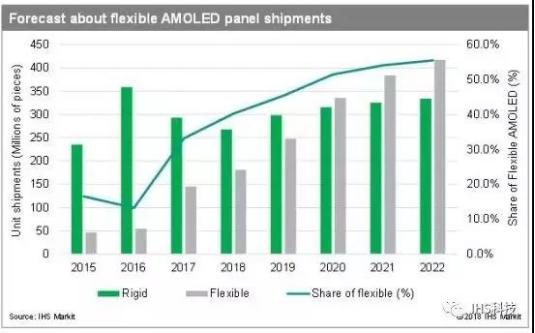

Flexible OLEDs will become the “new blue sea” of smart devices: It is expected that as OLED technology matures and costs tend to decline, more electronic devices will adopt OLED technology. In terms of applications, smart phones are still the most important application of OLED panels, accounting for 88%. The larger incremental point in the future lies in the continued penetration of the full screen and the increase brought by the folding screen. Other electronic devices, including wearable devices, in-vehicle displays, home appliances, and VR devices, will also gradually adopt OLED technology. With the gradual development of downstream applications, in the long run, global OLED panel revenues may usher in a second outbreak. By 2021, OLED mobile phone panel shipments (including rigid, flexible and foldable) will exceed LCD, global OLED Panel revenue will continue to grow at double-digit growth rates.

The gap between domestic manufacturers and international manufacturers has further narrowed

With the help of LCD to OLED, OLED upgrade to flexible OLED, domestic manufacturers have also laid out the OLED industry chain, and began to challenge Samsung’s dominance. Among them, BOE is the leader among domestic manufacturers. Other domestic manufacturers are also active card positions such as Huaxing Optoelectronics, Visionox, and Shentian Ma.

Among them, in the upstream supply chain, limited by foreign patent blockade and protection, China lags behind South Korea, Japan, Germany and the United States. In the downstream terminal part, due to the shortage of the upstream supply chain, the downstream terminal part is also expensive. As for the OLED panel and module part of the midstream, it is mainly attributed to the yield and capacity of the panel factory. It is believed that with the increase in yield and capacity, the large-scale popularization of flexible OLEDs in the future will not be too big a problem.

Post time: Apr-11-2019